On April 25, 2024 the OECD/G20 Inclusive Framework on BEPS (“OECD inclusive framework”) released its Consolidated Commentary to the Global Anti-Base Erosion Model Rules. This commentary integrates guidance endorsed and published by the OECD inclusive framework by the end of December 2023. It offers guidance to both tax administrations and taxpayers on interpreting and applying the GloBE Rules. This aims to ensure a uniform understanding and application, fostering coordinated outcomes for tax administrations and MNE Groups.

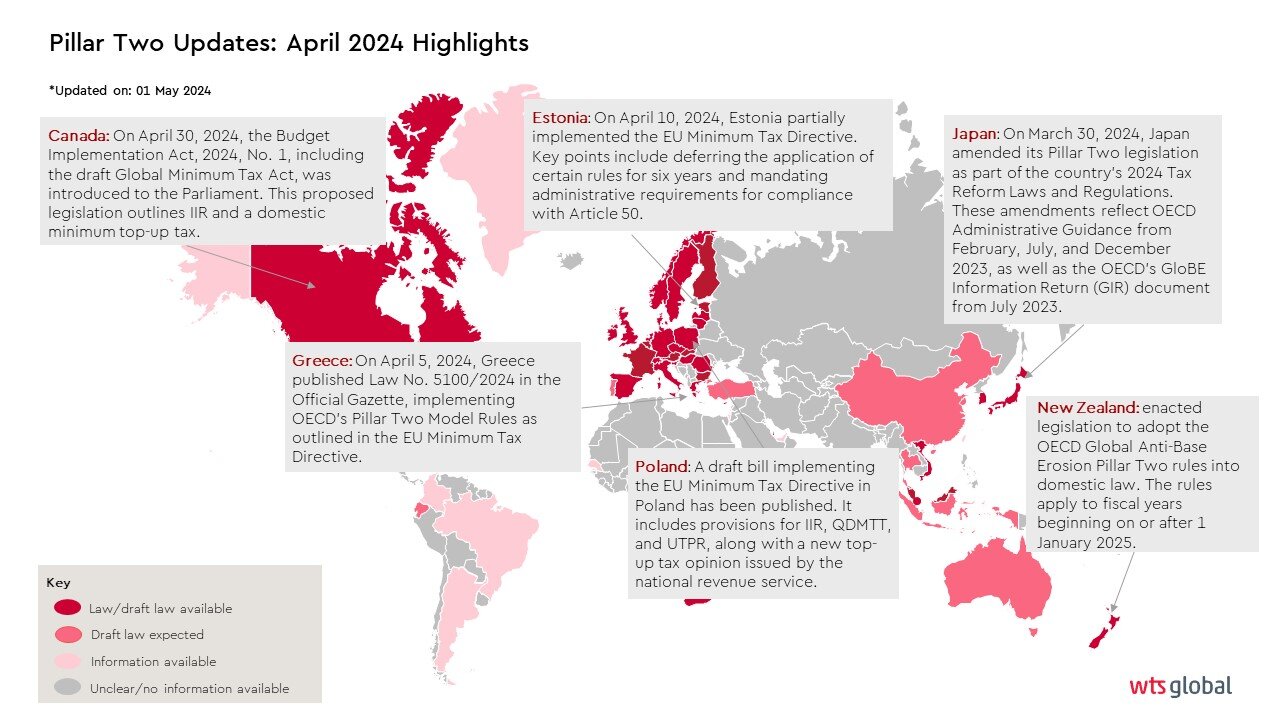

Meanwhile, countries worldwide continued their efforts to integrate the OECD’s Pillar Two rules into their national legislation. Here’s an overview of the latest advancements from April:

- Canada: On April 30, 2024, Canada presented the Budget Implementation Act, 2024, No. 1, to Parliament, including the draft Global Minimum Tax Act. This proposed legislation introduces an income inclusion rule and a domestic minimum top-up tax, reinforcing Canada’s commitment to global tax fairness.

- Estonia: On April 10, 2024, Estonia partially implemented the EU Minimum Tax Directive. The legislation focuses on administrative requirements for compliance with Article 50, mandating designated foreign entities for filing and intra-group information exchange. It doesn’t include provisions for the Income Inclusion Rule or Undertaxed Profits Rule, and it’s uncertain if a Domestic Minimum Top-up Tax will be applied later.

- Japan: On March 30, 2024, Japan amended its Pillar Two legislation as part of the country’s 2024 Tax Reform Laws and Regulations. These amendments, effective from fiscal years starting on or after April 1, 2024, reflect OECD Administrative Guidance from February, July, and December 2023, as well as the OECD’s GloBE Information Return (GIR) document from July 2023. They include detailed rules for the Transitional CbCR Safe Harbor and GIR, ensuring eligibility for MNE groups not required to file CbCR.

- Greece: On April 5, 2024, Greece published Law No. 5100/2024 in the Official Gazette, implementing OECD’s Pillar Two Model Rules as outlined in the EU Minimum Tax Directive. The law closely resembles the previously released draft from February 2024 and aligns with the EU directive. It incorporates transitional Country by Country Reporting Safe Harbour, UTPR Safe Harbour, and permanent QDMTT Safe Harbour. However, it does not include additional elements from OECD Administrative Guidance, though explanatory notes reference it.

- Iceland: Fiscal Strategy Plan for 2025-2029, released on April 16, 2024, confirms the intention to adopt Pillar Two. The plan outlines Iceland’s commitment to implementing a global minimum tax, scheduled for completion in the second half of the current year and set to take effect in 2025.

- Luxembourg: Luxembourg’s tax authorities released FAQs on March 25, 2024, providing insights into Pillar Two law provisions. Further guidance on additional topics is anticipated to be added to the FAQs in the future.

- Poland: A draft bill to implement the EU Minimum Tax Directive was released on April 30, 2024. It includes provisions for an Income Inclusion Rule (IIR), Qualified Domestic Minimum Tax Threshold (QDMTT), and Undertaxed Profits Rule (UTPR). Additionally, the bill introduces a new legal instrument called a “top-up tax opinion,” issued by the national revenue service, which addresses specific global minimum tax questions. Applying for a top-up tax opinion incurs fees ranging from PLN 25,000 to PLN 75,000. While the bill is expected to take effect on January 1, 2025, it may allow for voluntary application of its provisions as early as January 1, 2024.

As these changes continue to evolve, it is imperative for businesses and stakeholders to stay informed and adapt to the new tax landscape. WTS Global, with its expansive network spanning over 100 countries, remains committed to providing a comprehensive overview of the Pillar Two implementation status in 72 countries. If you have specific inquiries regarding the Pillar Two rules and their implications for your business, we encourage you to reach out to our tax experts.